The startups building their real value in the market can face a myriad of challenges, from edifying a customer base to securing funding. However, one critical issue that can never be overlooked is the need for PCI DSS compliance.

The purpose of the Payment Card Industry Data Security Standard (PCI DSS) is to ensure that credit card data is handled, received, stored, and safely transmitted by businesses. It is the process of accepting a transaction via POS (Point of Sale) and non-POS channels to ensure data integrity against data breaches and threats.

The PCI DSS Compliance can be costly. For instance, big enterprises transact more than 300,000 payments in a year, which makes PCI Compliance costly. But for small businesses or startups, with fewer transactions the compliance readiness becomes different.

Now you might ask, how can you be PCI DSS Compliance Ready for your small business? What is the average cost of PCI DSS Compliance for your small business?

Answering the importance and process of PCI DSS Compliance for your small business with real insights, we want to present you with this article.

A Complete Stat of PCI DSS For Small Business

Many small businesses and even home-grown enterprises think there is no need to be PCI DSS compliant. But it is a myth of their own, which can only bring fines and threats to their enterprises.

Even with a single electronic transaction annually, compliance with PCI DSS Security Requirements is mandatory.

According to recent statistics, over 60% of small businesses that suffer a cyber-attack go out of business within six months.

According to recent studies of 2019, over 53% of cyber attacks target small businesses, making them vulnerable to data breaches. Among these, only 15% of enterprises can defend them.

Not only this, it is also estimated in a recent study that the average cost of a data breach for a small business is around $36,000, not including the potential fines and legal fees associated with non-compliance.

So, to safeguard your emerging business, following PCI DSS regulatory compliance is a mandate.

What are PCI DSS requirements for small businesses?

PCI DSS compliance for small businesses involves several key requirements, including:

- Secure network architecture

- Protection of cardholder data

- Implementation of strong access control measures

- Regular monitoring and testing of networks

- Maintenance of an information security policy

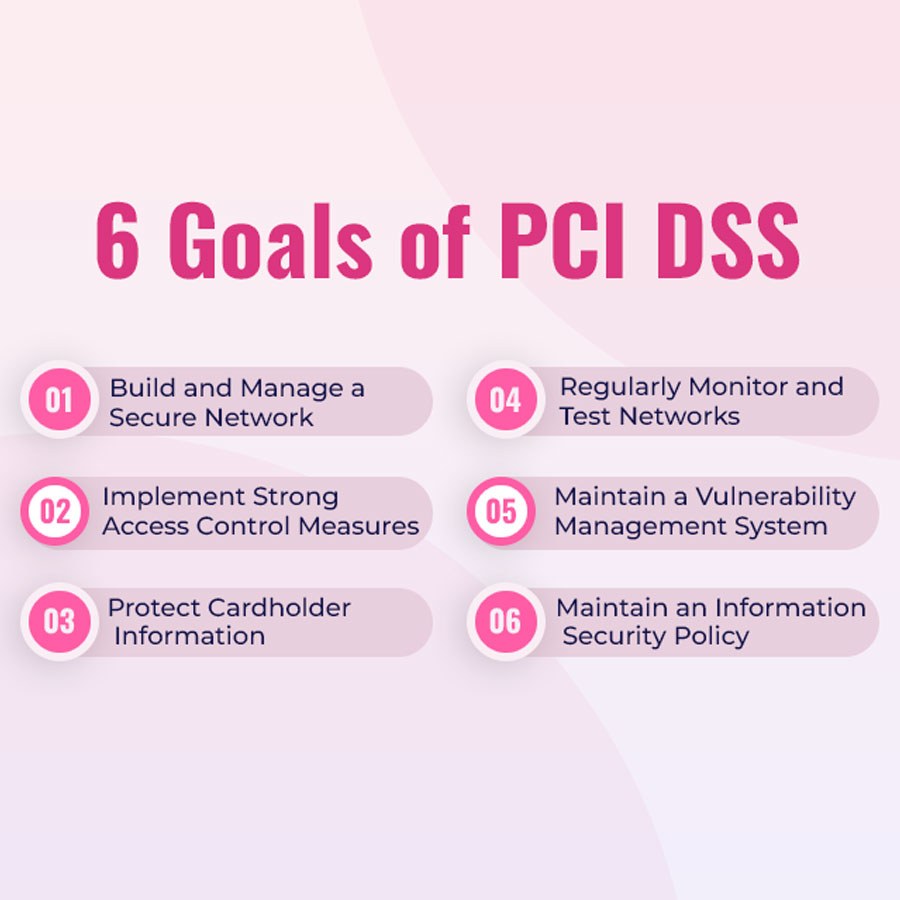

Not just that, to achieve PCI DSS compliance, small businesses must adhere to the 12 PCI DSS security requirements and align them with the six primary goals of PCI. Each requirement aims to ensure the integrity and security of data processed, stored, or transmitted by the organization.

Here’s a glance at PCI DSS Security requirements –

What four compliance levels are involved with PCI DSS?

PCI DSS (Payment Card Industry Data Security Standard) categorizes businesses into four levels based on their transaction volume over 12 months. These levels determine the specific requirements and validation processes for achieving compliance.

Level 1:

- Description: Businesses processing over 6 million Visa or Mastercard transactions annually.

- Requirements: Must undergo an annual onsite PCI DSS assessment by a Qualified Security Assessor (QSA) and submit a Report on Compliance (ROC).

- Stat: In 2020, 81% of Level 1 merchants achieved full compliance, up from 27.9% in 2011.

Level 2:

- Description: Businesses processing 1 to 6 million Visa or Mastercard transactions annually.

- Requirements: Complete an annual self-assessment questionnaire (SAQ) and undergo a quarterly network scan by an Approved Scanning Vendor (ASV).

- Stat: Despite the increase in data breaches, only 27% of Level 2 merchants were compliant with PCI DSS in 2020.

Level 3:

- Description: Businesses processing 20,000 to 1 million Visa or Mastercard e-commerce transactions annually.

- Requirements: Complete an annual SAQ and undergo a quarterly network scan by an ASV.

- Stat: In 2020, 48% of Level 3 merchants were compliant with PCI DSS, a decrease from 54.4% in 2019.

Level 4:

- Description: Businesses processing fewer than 20,000 Visa or Mastercard e-commerce transactions annually, and all other merchants processing up to 1 million Visa or Mastercard transactions annually.

- Requirements: Complete an annual SAQ and undergo a quarterly network scan by an ASV.

- Stat: Only 27.9% of Level 4 merchants were compliant with PCI DSS in 2020, a slight increase from 26.6% in 2019.

Did you know?

The Hiscox report shows that 34% of small businesses with fewer than 50 employees were attacked and breached in the first quarter of 2022. This means that the average cost of PCI compliance for these small businesses increased. The average cost of PCI compliance for affected small businesses has risen to more than $300,000 per year. Unfortunately, most small businesses did not survive this impact.

How to get your small business PCI DSS compliant?

Step 1: Determine Your Compliance Level

- Small businesses are typically classified as Level 4, but verified based on your annual Visa transaction volume.

- Use your POS machine to obtain reports on total transactions in a period.

Step 2: Fill Out the PCI Compliance SAQ

- Based on your transaction nature, fill out the relevant SAQs for each type of transaction.

- For example, use SAQ-A if you use a payment gateway like Razorpay, SAQ-C for a physical store with a POS system, or SAQ-C-VT for phone orders and online invoices.

- Download the SAQ and relevant forms from the official PCI DSS website.

Step 3: Investigate Your Payment Technology

- Implement PCI-compliant payment gateways for secure cardholder data transmission.

- Install SSL and use encryption codes for secure communication between your website and web browser.

- Ensure access control, maintain login logs, and implement 2FA and P2PE.

Step 4: Create and Document the Security and Compliance Process

- Document all security controls and policies implemented within your business.

- Conduct training sessions for employees on data handling best practices.

- Regularly check POS devices for tampering and educate your team on securing them.

Step 5: Complete Your AOC

- Submit the SAQ for formal review and approval by a Qualified Security Assessor (QSA).

- Ensure no section of the SAQ is left blank and sign where required before submission.

- Once approved, you’ll receive an Attestation of Compliance (AoC).

Step 6: Prove Compliance with Continuous Monitoring and Scanning

- Conduct vulnerability scans every three months with an Approved Scanning Vendor (ASV).

- Ensure your firewalls and networks are secure and submit scan results to the PCI council.

- Implement regular scans and document the results for compliance.

Step 7: Submitting PCI Documentation

- Compile and send a compliance report to the PCI council, including a summary of findings, audit details, and business information.

- Use email or a physical mailing system for submission.

Step 8: Track and Test Your Systems

- Continuously monitor and test your systems for compliance with PCI DSS.

- Document the results, compare them to detect patterns, and maintain a strong compliance posture.

Additional Tips for Small Businesses:

- Consider outsourcing PCI DSS compliance tasks to a Qualified Security Assessor (QSA) or a managed security service provider (MSSP) to ensure thorough compliance.

- Regularly review and update your security policies and procedures to address new threats and vulnerabilities.

- Educate your employees about the importance of PCI DSS compliance and their role in maintaining a secure environment.

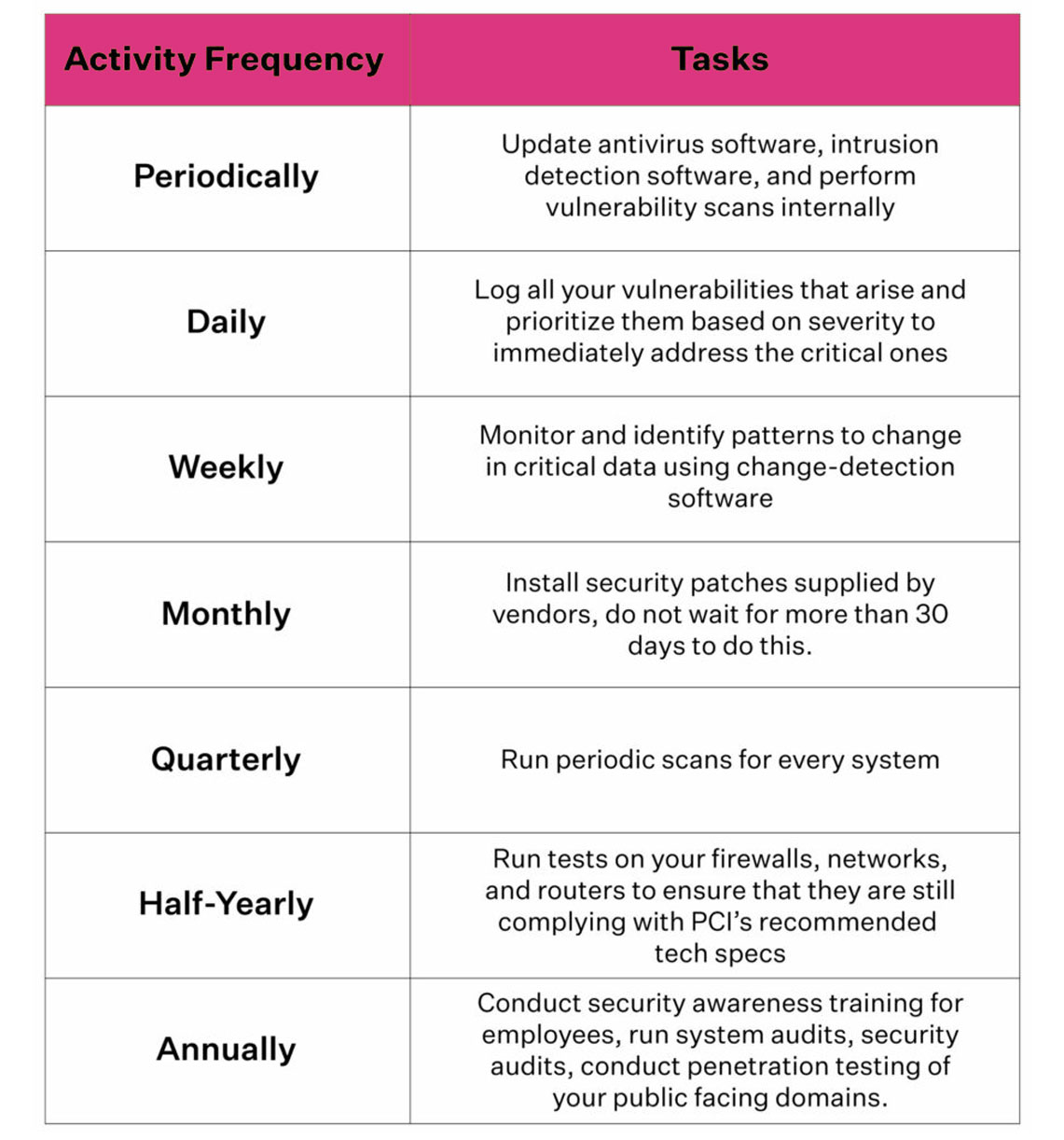

Or, you can also use this given cheat sheet for small business PCI DSS Compliance-

By following these steps and tips, your small business can achieve PCI DSS compliance and protect cardholder data from security breaches.

Why PCI DSS compliance for small businesses Is Vital In 2024?

- Data Security: PCI compliance ensures that sensitive payment data is protected from unauthorized access, reducing the risk of data breaches and fraud.

- Customer Trust: Compliance demonstrates to customers that their payment information is being handled securely, fostering trust and loyalty.

- Legal Requirements: Failure to comply with PCI DSS can result in significant fines and legal consequences, which can be detrimental to small businesses.

- Reputation Management: Non-compliance can damage a business’s reputation, leading to loss of customers and revenue.

- Cost Savings: By investing in PCI compliance, small businesses can avoid costly fines and penalties associated with data breaches and non-compliance.

- Business Continuity: Ensuring PCI compliance helps small businesses maintain operations and avoid disruptions caused by data breaches or legal issues.

- Competitive Advantage: PCI Compliant small businesses hold a competitive edge by demonstrating their commitment to data security and customer protection.

- Partnership Opportunities: Many larger companies require their partners and vendors to be PCI compliant, opening up new business opportunities for compliant small businesses.

The Socurely Way

For small businesses, PCI DSS compliance is crucial to protect sensitive customer data and avoid costly breaches. Socurely offers a solution that simplifies the process.

Socurely’s platform provides small businesses with the tools and guidance needed to navigate the complex requirements of PCI DSS. Our step-by-step approach helps you identify your compliance level, fill out the Self-Assessment Questionnaire (SAQ), and implement necessary security measures.

With Socurely, you can conduct vulnerability scans, monitor your systems for potential risks, and generate Attestation of Compliance (AoC) reports. Our platform also offers continuous monitoring and scanning, ensuring that your business remains compliant over time.

Partnering with Socurely not only helps you achieve PCI DSS compliance but also gives you peace of mind knowing that your business is protected against data breaches. Join Socurely today and make PCI compliance a seamless part of your business operations.

Conclusion

PCI DSS compliance for start-ups and middle-sized businesses is important for many reasons. It protects business and customer data and also brings added security to your business. By understanding and implementing PCI DSS requirements, start-ups can ensure a secure environment for processing credit card transactions and mitigate the risk of data breaches.